Annuities Explained

How Do They Work?

Annuities are purchased to provide stable growth as well as capital and income guarantees for long term savings. Growth is provided through competitive interest rates, while guarantees are backed by an insurance company’s capital.

Unlike short term low interest instruments such as certificates of deposit and savings accounts, annuities have higher interest rates and longer terms which are usually seven years or longer. To provide attractive long-term interest rates, insurance companies build up high quality bond portfolios.

Most of the interest earned from this portfolio is paid out to their annuity clients and they keep a small margin to cover their operational expenses and profit. Since insurance companies guarantee the principal invested in annuities, insurance companies are required to have strict cash reserves invested conservatively.

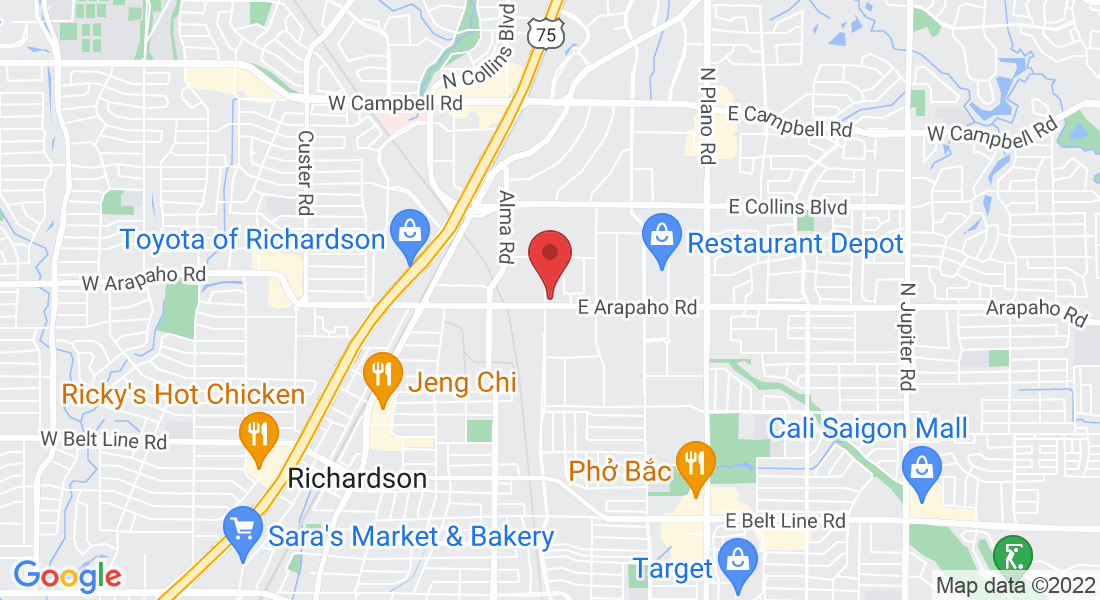

833 East Arapaho Road, Suite 107

Richardson, TX 75081

Phone: (214) 739-5610

Fax: (214) 739-5404

License #6041

Account Service / Contact Us

Hours of Operation

Monday: 9:00 am - 5:00 pm

Tuesday: 9:00 am - 5:00 pm

Wednesday: 9:00 am - 5:00 pm

Thursday: 9:00 am - 5:00 pm

Friday: 9:00 am - 5:00 pm